Real Estate Market Challenges & Our Law Firm's Approach

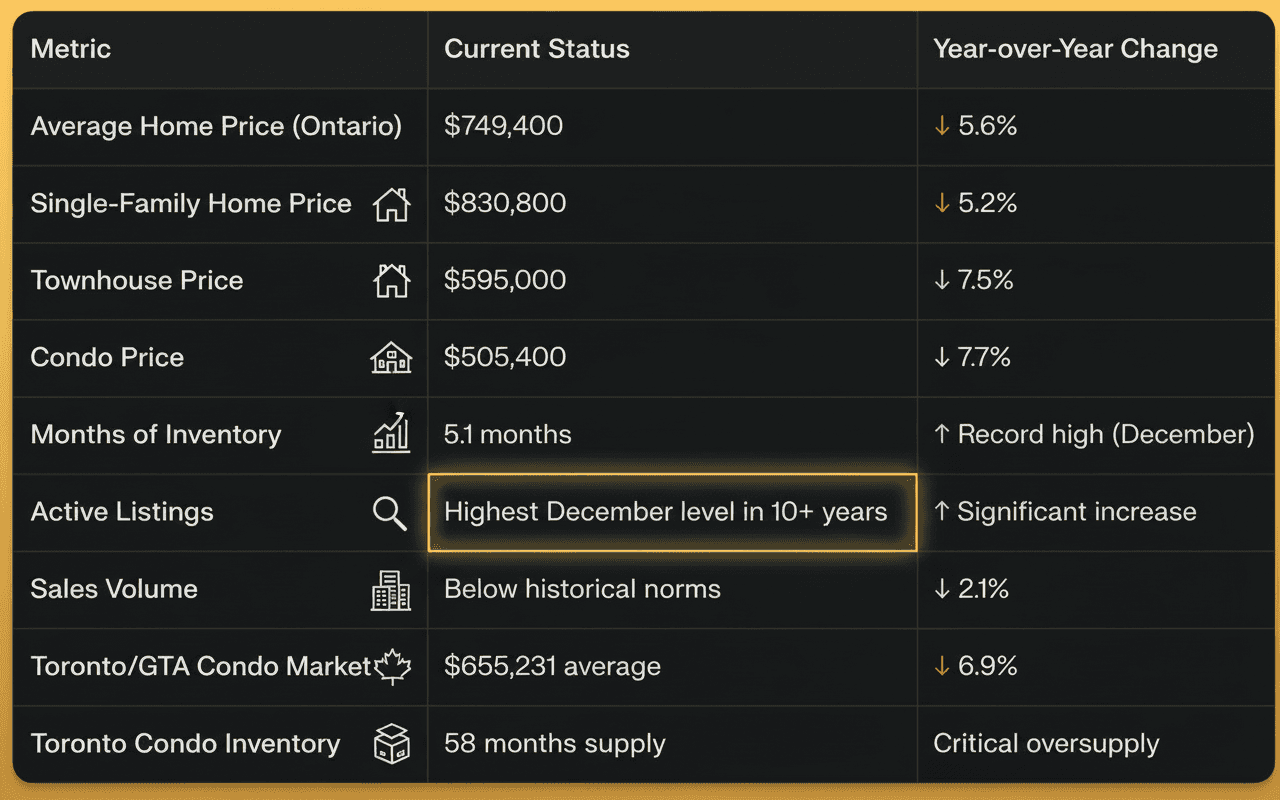

Ontario's real estate market in 2026 presents unprecedented challenges for both buyers and sellers, with systemic pressures creating complex legal and financial risks that demand experienced legal representation.

Market Characterization: Ontario is Canada's weakest housing market, with prices posting the steepest decline of any region. The market has shifted decisively to favor buyers, but this creates elevated transaction risks for all parties.

The GTA Condo Crisis: A Market in Distress

The Greater Toronto Area condo market faces exceptional challenges:

58 months of inventory (over 4 years' worth at current sales rates)

Normal balanced market: 3-4 months of inventory

New condo sales: 1,807 units sold in first 10 months of 2025 (↓ 56% from 2024)

Record completions: ~29,000 new condos completing in 2024-2025, flooding the market

Assignment market collapse: Pre-construction buyers unable to close or assign contracts

Price decline from peak: 15-20% from 2023 highs

Legal Risk: Thousands of buyers who purchased pre-construction condos years ago now face closing on properties worth significantly less than their contracted purchase price, leading to financing failures, deposit forfeitures, and breach of contract disputes.

OUR LAW FIRM'S APPROACH: PROACTIVE, PROTECTIVE, RESULTS-DRIVEN

At AboutLaw.ca, we recognize that Ontario's 2026 real estate market presents unprecedented complexity and risk. Our approach is designed to anticipate problems, protect your interests, and ensure successful closings even in challenging conditions.

Our Four-Pillar Real Estate Protection Strategy

PILLAR 1: EARLY ENGAGEMENT & RISK ASSESSMENT

What We Do:

Pre-Offer Legal Review (Recommended Before Signing)

Review draft Agreement of Purchase and Sale BEFORE you sign

Identify problematic clauses, missing protections, ambiguous terms

Recommend conditions to protect your interests (financing, inspection, sale of property, lawyer review)

Advise on deposit amount (minimize risk exposure)

Flag unusual terms or seller demands that create legal risk

Immediate Post-Acceptance Engagement

Engage us immediately after offer accepted (don't wait weeks)

Conduct preliminary title search within 48 hours

Identify potential title issues early (weeks before requisition deadline)

Order survey, property tax certificate, utility clearances immediately

Frontload due diligence to maximize time for issue resolution

Market Condition Analysis

Assess current market trends affecting your transaction

Advise on appraisal risk based on recent comparables

Identify financing red flags (mortgage stress test, debt ratios, employment verification)

Provide realistic timeline expectations and delay contingencies

Why This Matters:

80% of closing problems can be prevented or mitigated with early identification

Title defects discovered 3 weeks before closing = time to cure

Title defects discovered 3 days before closing = crisis

Client Outcome: Buyers and sellers have full visibility into transaction risks BEFORE points of no return, enabling informed decisions and proactive solutions.

PILLAR 2: COMPREHENSIVE DUE DILIGENCE & TITLE PROTECTION

What We Do:

Thorough Title Examination (Ontario Land Registry System via Teraview)

Search 40+ years of title history (exceeding standard 40-year requirement)

Identify all registered encumbrances: mortgages, liens, easements, restrictive covenants

Execution searches on all parties (judgment creditors, bankruptcy, writs)

Corporate searches (if seller is corporation)

Estate searches (if seller is estate trustee/executor)

Municipal tax and utility arrears searches

Planning Act compliance verification (subdivision, zoning)

Construction Lien Risk Assessment

Verify dates of construction/renovation

Calculate 45-day lien period expiry

Search for registered construction liens

Obtain statutory declarations from seller regarding contractor payments

Recommend title insurance coverage for lien risks

Advise on closing delay if construction recently completed (to allow lien period expiry)

Survey and Boundary Review

Review current survey (if available) or order new survey

Identify boundary encroachments, easements, rights-of-way

Compare survey to zoning by-laws (setback requirements)

Flag issues requiring resolution or title insurance coverage

Environmental Due Diligence

Review environmental reports (Phase I/II assessments if commercial)

Search records for underground storage tanks, contamination

Verify compliance with environmental regulations

Advise on environmental liability risks

Critical Deadline Management

Calculate and calendar ALL key dates: requisition date, condition dates, closing date, document delivery dates

Deliver requisitions (objections to title) BEFORE requisition deadline

Ensure seller has maximum time to cure defects

Follow up persistently on outstanding issues

Why This Matters:

35% of closings delayed by title issues

Early detection = early resolution

Missing requisition date = accepting defective title

Title insurance doesn't replace proper due diligence (it supplements it)

Client Outcome: Buyers receive clear, marketable title free from defects. Sellers can demonstrate clear title to facilitate smooth closing. Issues identified early with time for resolution.

PILLAR 3: FINANCING COORDINATION & CLOSING MECHANICS

What We Do:

Mortgage Lender Coordination

Communicate with lender's lawyer early and often

Confirm mortgage instructions and requirements

Verify mortgage funds release timeline

Identify documentation gaps early (insurance, pay stubs, appraisals)

Escalate issues to mortgage broker/lender if delays anticipated

Arrange backup plans if financing at risk

Closing Fund Management

Prepare detailed Statement of Adjustments 1 week before closing (not day before)

Verify all funds required for closing (down payment, land transfer tax, legal fees, adjustments)

Confirm method of fund delivery (bank draft, wire transfer, certified cheque)

Verify funds received in trust account with adequate clearance time

Never rely on "day-of" funds unless unavoidable

Same-Day Transaction Orchestration

Structure same-day sale/purchase with appropriate time gap (sale closes morning, purchase closes afternoon)

Arrange holdback protections if necessary

Communicate with other lawyers to coordinate timing

Monitor sale closing progress in real-time

Have contingency plans if sale delayed

Registration Timing Optimization

Avoid month-end, Fridays, pre-holiday closings when possible

Schedule registration for mid-day (10:00 AM - 2:00 PM window) to allow buffer

Use electronic registration (Teraview) for speed

Monitor Land Registry system for delays

Complete registration immediately upon receiving all funds and documents

Title Insurance Placement

Recommend appropriate title insurance coverage (not just lender's policy)

Obtain owner's title insurance policy (one-time premium, lifetime coverage)

Ensure coverage for: fraud, title defects, survey issues, construction liens, zoning violations, access issues

Cost: $200-$500 (one-time) for lifetime protection

Why This Matters:

35% of closing delays are financing-related

Proactive coordination prevents last-minute crises

Same-day transactions require expert choreography

Title insurance is essential backup protection

Client Outcome: Closings proceed on schedule with funds in place, documents registered timely, and keys delivered as planned. Title insurance provides lifetime peace of mind.

PILLAR 4: AGGRESSIVE PROBLEM RESOLUTION & LITIGATION READINESS

What We Do:

Proactive Issue Resolution

Negotiate directly with opposing counsel to resolve title defects

Coordinate mortgage discharges, lien payments, judgment satisfactions

Obtain indemnities from sellers for unresolved minor issues

Structure price adjustments when issues cannot be fully cured

Negotiate extensions when necessary (with client consent)

Mediate disputes over contract interpretation, property condition, included chattels

Deposit Protection Strategies

For Buyers:

Structure deposits to minimize risk (recommend conditions, holdbacks)

Negotiate deposit return provisions if conditions not satisfied

Document ALL efforts to satisfy conditions (good faith requirement)

Advise on relief from forfeiture prospects if facing default

Pursue equitable remedies if seller breach or bad faith

For Sellers:

Enforce deposit forfeiture rights when buyer defaults

Pursue additional damages if deposit insufficient to cover losses

Mitigate damages through timely re-listing

Document all losses (carrying costs, price decline, legal fees)

Defend against unwarranted relief from forfeiture claims

Litigation & Dispute Resolution

Pre-litigation demand letters and negotiations

Ontario Superior Court of Justice litigation if necessary

Specific performance claims (forcing completion)

Damages claims (compensating losses)

Injunctive relief (preventing wrongful actions)

Summary judgment motions (expedited resolution)

Transaction Rescue Services

Creative solutions to save transactions on verge of collapse

Vendor take-back mortgages (seller financing)

Price renegotiations based on appraisals, market changes

Repair escrows/holdbacks for condition issues

Interim occupancy agreements if closing delayed

Why This Matters:

Not all transactions close smoothly—expert problem-solving is essential

Deposit forfeiture ($40,000-$100,000+) is catastrophic—aggressive protection required

Early legal intervention often saves transactions that would otherwise fail

Litigation readiness encourages opposing party to negotiate reasonably

Client Outcome: Problems resolved efficiently and cost-effectively. Deposits protected. Transactions rescued from brink of failure. When litigation necessary, aggressive representation to achieve favorable outcomes.